Navigating Egypt’s Financial Future

In the ever-evolving landscape of Egypt’s financial ecosystem, Suez Canal Bank continues its efforts to provide innovative and comprehensive services and products that meet the needs of all its customers. Recognized as the Treasury Management Bank of the Year 2024 – Egypt from International Business Magazine (IBM), this financial powerhouse has redefined treasury operations to drive resilience, economic growth, and operational efficiency. As the cornerstone of the bank’s strategy, treasury management not only optimizes liquidity and minimizes risks but also fuels Egypt’s journey toward financial prosperity.

Treasury Management: The Heartbeat of Strategic Success

At its essence, treasury management represents the lifeblood of an organization’s financial health. By ensuring the seamless flow of funds, mitigating risks, and maxiamizing performance, it orchestrates the balance between stability and growth.

For Suez Canal Bank, this function is not merely an operational task; it is a strategic imperative. As a pillar of Egypt’s financial infrastructure, the bank has made treasury management the driving force behind its mission. From cash forecasting and investment management to compliance and risk mitigation, the bank’s treasury department exemplifies precision and foresight. This robust framework strengthens Suez Canal Bank’s resilience, allowing it to adapt to the dynamic market environment while delivering unparalleled value to its clients.

Empowering Egypt’s Economy

Suez Canal Bank’s contributions go beyond corporate boardrooms. It serves as a critical partner in Egypt’s economic development, investing in sectors that shape the nation’s future. By financing infrastructure projects, supporting entrepreneurial ventures, and fostering growth across industries, the bank plays a pivotal role in fueling Egypt’s ambitions.

Treasury management, with its meticulous cash flow strategies, amplifies this impact by ensuring efficient funding and investment operations. This approach not only strengthens the bank’s profitability but also creates a ripple effect of stability and growth throughout Egypt’s economy.

Suez Canal Bank is always keen to support vital economic sectors that contribute to driving the growth of the national economy. This is achieved through financing major projects that add value to the Egyptian economy and providing the necessary facilities to meet the needs of institutions and achieve their goals, both in the local market and in expanding to international markets, in line with Egypt’s vision and ensuring sustainable growth.

This strengthened by the establishment of the International Banking Operations Department (GTB) to offer integrated banking services that contribute to the development of businesses and institutions and enhance their growth in a competitive environment. In addition, the bank is expanding its partnerships with various institutions and offering diverse financing solutions to support their growth plans.

Innovation at the Core: A Technological Revolution

In an age of digital transformation, Suez Canal Bank has embraced cutting-edge technologies to revolutionize its treasury operations. With a vision to Digitize, optimize, and evolve, the bank has integrated several technological advancements:

Digital Treasury Platforms: By introducing digital platforms for cash flow forecasting, liquidity management, and payment processing, the bank has significantly enhanced accuracy and efficiency.

Core System Upgrades: The automation of manual processes through upgraded core banking systems has saved time, reduced errors, and scaled operations to meet the needs of a growing clientele.

Enhanced Decision-Making: These innovations empower treasury teams with real-time data and analytics, enabling informed, strategic decision-making at every turn.

The result? A treasury function that is not only efficient but also agile, capable of adapting to the complexities of modern financial landscapes.

Shaping Tomorrow’s Financial Landscape

As Egypt strides toward a brighter financial future, Suez Canal Bank is keen to keep pace with this transformation”. It keeps track of innovation, strategic treasury management, and economic empowerment which sets a benchmark for excellence in the banking sector.

The recognition as Treasury Management Bank of the Year is not just an accolade but a testament to Suez Canal Bank’s contribution in shaping Egypt’s financial ecosystem. With a steadfast focus on resilience, innovation, and growth.

Devotion to Best Practices

Suez Canal Bank demonstrates its Devotion to global standards by aligning its treasury management practices with international frameworks such as Basel III. This alignment ensures robust liquidity and capital risk management, enabling the bank to remain resilient in the face of a constantly shifting financial landscape. By integrating rigorous compliance frameworks, conducting regular audits, and leveraging advanced risk management tools, the bank fosters a culture of vigilance and adaptability. These efforts not only meet global regulatory requirements but also establish Suez Canal Bank in Egypt’s financial sector.

A Blueprint for Excellence

The bank’s treasury management practices are rooted in a clear and strategic approach designed for efficiency and scalability. From implementing intuitive, user-friendly treasury solutions with automated workflows to integrating systems with existing financial platforms, Suez Canal Bank ensures seamless operations. Prioritizing security and compliance, the bank emphasizes scalable solutions tailored to future growth while offering continuous training and support for its teams. This holistic approach guarantees that the bank stays ahead of industry trends, empowering its clients with innovative, secure, and effective treasury management solutions.

Redefining Treasury Services

Suez Canal Bank has embraced a forward-thinking approach to treasury management by introducing a range of innovative products and services designed to address the dynamic needs of its clients. Recognizing the growing demand for automation and e-banking, the bank has launched advanced treasury solutions that prioritize efficiency and customization. These include derivatives and liability products with diverse features, tailored to provide flexibility and enhanced financial control for clients navigating an increasingly complex market landscape.

Sustainability and Digital Transformation

The bank’s recent initiatives emphasize a dual focus on sustainability and digital transformation. With the launch of cash management tools and digital payment platforms, corporate clients can now monitor liquidity and streamline transactions effortlessly.

In line with SCB’s strategy for digital transformation, Sustainability data collection is carried out through a digital management tool to ensure a higher level of efficiency and accuracy. In 2025 SCB sustainability report will integrate more frameworks, in addition to GRI.

By the end of 2024, all SCB staff received “Paper reduction awareness “as a preliminary step for a holistic action plan targeting optimum paper reduction through 2025. This was preceded by “ESG awareness” across all SCB staff.

The Bank has Launched three products—solar, electric vehicles, and micromobility—for retail, SME, and corporate customers, promoting cleaner energy and transportation. On the corporate level SCB finances projects related to ESG. SCB has also measured financed emissions for their top corporate clients and disclosed the report on their website. Going forward, SCB will play an active role to assist customers in their ESG transformation journey.

CSR

Suez Canal Bank prioritizes social responsibility and community development, consistently working to implement impactful programs that address the community’s needs.

The bank focuses on eight key areas: health, education, social solidarity, supporting individuals with special needs, empowering youth, fostering entrepreneurship, advancing women’s empowerment, and promoting sports, arts, and culture.

The bank continues to strengthen its role in social responsibility by launching various community initiatives and encouraging a culture of volunteerism among its employees. These efforts align with the Sustainable Development Goals and Egypt’s Vision 2030.

Building Lasting Partnerships

Clients have consistently praised Suez Canal Bank for its tailored treasury solutions and exceptional service quality. The bank’s dedication to understanding and meeting client needs is evident in its comprehensive approach to relationship management. Through regular surveys, feedback sessions, and a dedicated team of relationship managers, the bank ensures personalized attention and prompt responses to queries. By continuously innovating its digital platforms and enhancing user experiences, Suez Canal Bank remains a trusted partner for clients navigating complex financial challenges.

Collaboration and Innovation

Suez Canal Bank’s partnerships extend beyond its clients to include strategic collaborations within the banking sector. These alliances have proven invaluable in delivering innovative solutions and maintaining the bank’s competitive edge. By leveraging its strong network and commitment to client-centric innovation, the bank has not only strengthened its position in the market but also contributed to the overall growth. These efforts underscore Suez Canal Bank’s leadership in driving mutual growth and fostering a vibrant economic ecosystem.

Embracing Advanced Technologies

Suez Canal Bank envisions a future where cutting-edge technology transforms its treasury management capabilities. Plans are underway to launch advanced treasury and Asset-Liability Management (ALM) systems, streamlining financial operations for greater efficiency and precision. By integrating these technologies, the bank aims to enhance liquidity management, optimize resource allocation, and ensure seamless service delivery. This forward-looking approach reflects the bank’s keenness to staying ahead in a competitive market while maintaining a strong focus on innovation and excellence.

Strategic Growth and Sustainability

As part of its strategic roadmap, Suez Canal Bank is dedicated to expanding its treasury products and services with a strong emphasis on sustainability. By aligning its offerings with global environmental and governance standards, the bank seeks to contribute to Egypt’s broader economic and ecological goals. Additionally, the bank prioritizes developing its human resources, fostering a culture of continuous learning, and equipping its teams with the skills needed to navigate an evolving financial landscape. These efforts aim to increase market share, achieve sustainable growth, and solidify the bank’s reputation in treasury management.

Embracing Technology and Innovation

Suez Canal Bank encourages financial institutions to prioritize the adoption of advanced technology in their treasury operations. Investing in digital platforms and AI-driven tools not only enhances operational efficiency but also provides a competitive edge in a rapidly evolving market. By collaborating with fintech companies, banks can leverage cutting-edge solutions to streamline processes and improve decision-making. Institutions should also embrace continuous innovation, designing unique treasury solutions tailored to the diverse needs of their clients, to remain ahead in the competitive landscape.

Sustainability and Risk Management

A robust risk management framework is essential for navigating liquidity and market challenges. Suez Canal Bank emphasizes the importance of integrating ESG principles into treasury products to align with global sustainability goals. This dual focus on risk mitigation and sustainability not only strengthens the bank’s operational foundation but also enhances its reputation as a responsible financial institution. By prioritizing these areas, other banks can achieve long-term growth while contributing to global environmental and governance standards.

SCB is currently working on integrating environmental and social management system in their business decisions.

A Legacy of Excellence and a Vision for Growth

Reflecting on its journey, Suez Canal Bank takes pride in its leadership in treasury management and its keenness to delivering exceptional financial services. With a focus on enhancing the digital experience and expanding its service offerings, the bank has ambitious initiatives planned to drive further growth. By staying true to its values of innovation, collaboration, and sustainability, Suez Canal Bank continues to set benchmarks in the industry, inspiring other financial institutions to strive for excellence.

Empower Your Future with Vision and Resilience

To the youth, remember that the journey to success is paved with determination, adaptability, and a willingness to learn. Embrace challenges as opportunities to grow and never shy away from innovation. In today’s dynamic world, the ability to think creatively, take calculated risks, and remain committed to your goals will set you apart. Equip yourself with knowledge, stay curious, and continuously upskill to keep pace with an ever-changing global landscape.

Lead with Integrity and Purpose

True success lies not just in personal achievements but in the positive impact you make on others. Let your actions be guided by integrity and a sense of purpose. Strive to build a better world by making decisions that are inclusive, ethical, and sustainable. The future is yours to shape—dream big, stay grounded, and work hard to transform your aspirations into reality. With resilience and passion, you can create a legacy that inspires generations to come.

Recognizing Excellence

Suez Canal Bank has earned several prestigious international appreciations, including:

- Being listed for the fourth time among Forbes’ “Top 50 Companies on the Egyptian Stock Exchange” for 2024.

- Inclusion, for the second consecutive year, in the Financial Times’ “Fastest Growing Companies in Africa” list for 2024.

- Receiving the “Rising Star” award from Euromoney in 2024.

- Winning the “Best Trade Finance Bank in Egypt for 2024” award from the Union of Arab Bankers.

- Receiving the “Treasury Management – Egypt 2024” award from International Business Magazine (IBM).

- Receiving “Excellence in Corporate Credit Solutions – Egypt 2024” Award from the Global Economics.

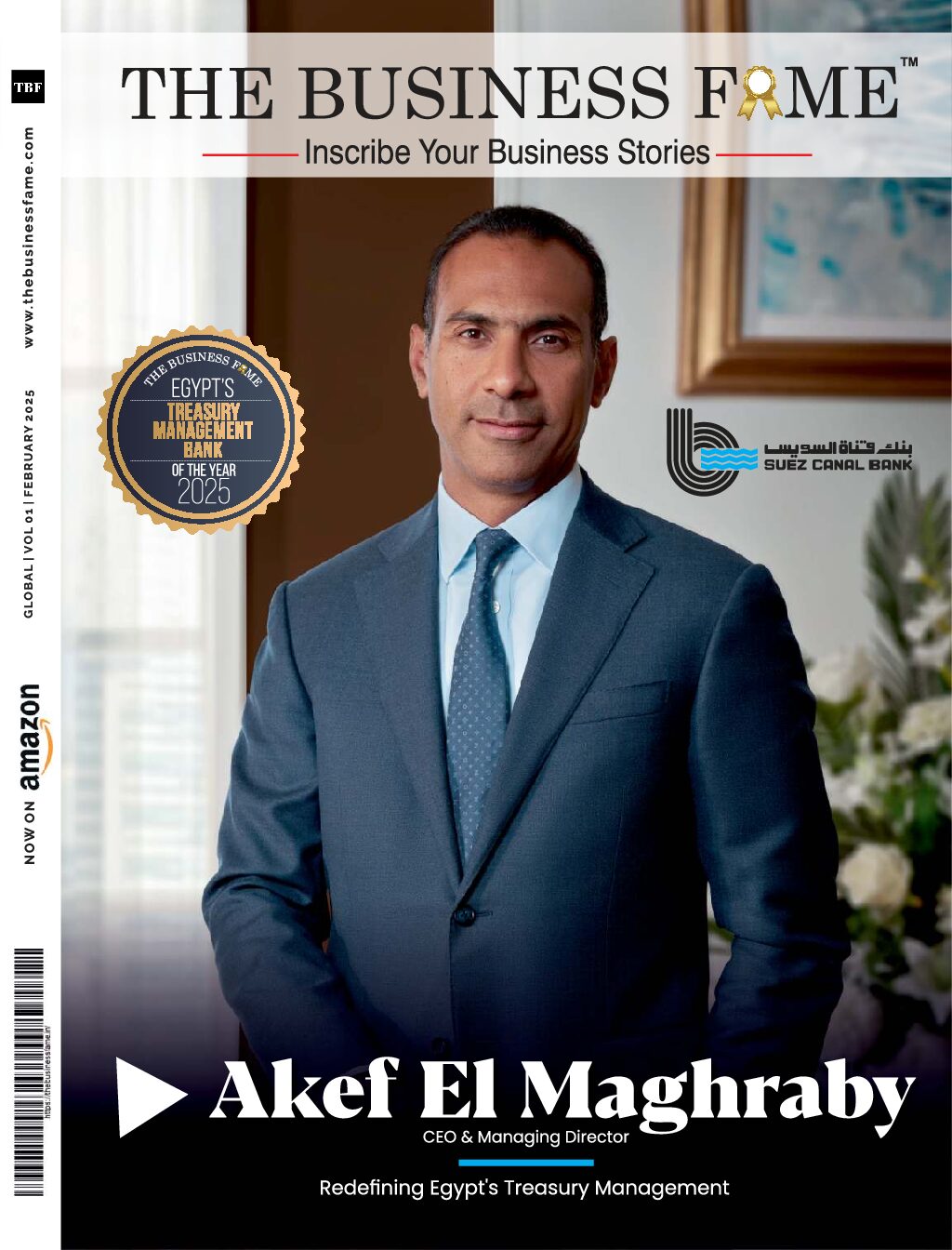

- Receiving “Best Banking CEO of the year 2025 – Akef El Maghraby” Award from Global Business and Finance Magazine.

- Receiving “Best CSR Bank Egypt 2025” Award from World Business Outlook.

- Receiving “Fastest Growing Retail Banking in Egypt 2025” Award from International Business Magazine

- Receiving “Best Bank in Digital Transformation Egypt 2025” Award from International Business Magazine

These recognitions reaffirm the bank’s potential for growth, expansion, and continued success in the coming years.

About Suez Canal Bank

Suez Canal Bank is an Egyptian joint stock company established as a commercial bank in 1978. The paid-up and the issued capital is EGP 6.5 billion and the number of shares is 650 million.

The bank provides corporate, retail and investment banking services in the Arab Republic of Egypt as well as Islamic banking services to companies and individuals through 53 branches and a representative office in Libya and a network of correspondents around the world.

The number of employees has reached more than 1650 employees.