We all need financial advisors in our lives. Let’s look at them as a fitness coach. We all know how important it is to stay fit and healthy, but we can’t follow the regime due to the lack of discipline and our will to make things right. But a fitness coach, he will push us in the right direction and help us achieve our goals. The same is for a financial consultant, or advisor. We already know about investments and how they are healthy for a secure future, but only a financial advisor can take us to the right path and help us achieve our goals.

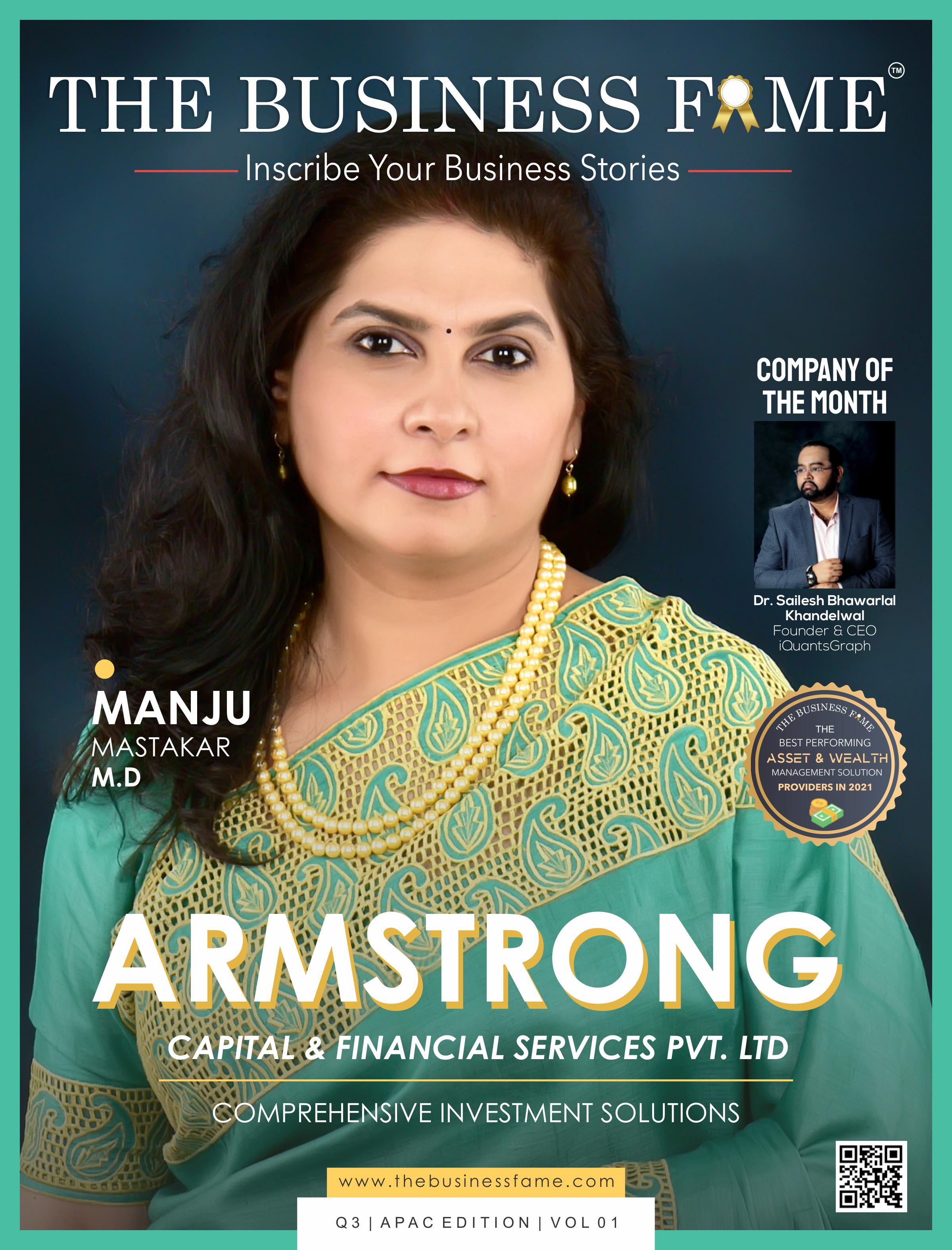

Featuring for the Cover Story of The Business Fame’s this issue of “The Best Performing Asset & Wealth Management Solution Providers in 2021” is Armstrong Capital Pvt. Ltd. Providing people with comprehensive solutions.

The Company-

Armstrong Capital is a dedicated team focused on providing the clients with unparalleled service in handling their financial affairs. Armstrong understands that managing investments need extensive research, regular monitoring, dedicated team and periodic reviews of investments. The team believes in fostering long term relationship with its clients based on trust and integrity. Whether you are an individual or institution you want your investments to be managed by someone you can trust, therefore Armstrong ensures that all the transactions are transparent and fosters a bond of trust with the clients.

The company provides goal based financial planning, portfolio management service, wealth management service, retirement planning for individuals.

A Journey through the Years-

Step by step moving up – first Manju focused on their offerings the financial plan and the research required for fund suggestion, then she focused on customer service that is required for swift transactions then on business development sales and pre/sales. That’s how slowly she grew the organization. It takes a lot of time, effort, energy and patience to build it.

In the early stages of business every milestone that the company crossed looked like a great accomplishment the first 100 clients came on board in 2 years , then they celebrated 1cr of SIP book and the most accomplishment was the 100 cr target that they achieved in 2019 inspire of the bear run in the markets.

“It’s a team work, and we celebrate it with the entire team.”

In this business the Investment Advisor is the core of the business as we have all functionalities very dynamic – the product, the advice, the relationship and the service. Manju Mastakar, the Founder and Managing Director of Armstrong Capital & Financial Services Pvt. Ltd. says she wants to build a very robust corporate wealth management company which has process and automation at its core.

“I want the business process to be atomized and not only the transactions.”

What makes Armstrong Capital Different?

“Radical truth and Radical Transparency are the principals that we have put to practice.”

The entire team has been transparent on the process that they follow while suggesting investments, they have also been cognizant on accepting mistakes and correcting them. The team takes regular feedback – its like a temperature check of the relationship on a regular basis. They proactively deliver the bad news earlier than- what the clients could hear from other sources. Like the markets could correct and stay low for 18-20 months. These are like setting real expectations.

Some of this may not sound as music to the clients, but the team believes in conveying their perception with transparency and that differentiates them from the rest of the competition.

The biggest competition is the client himself because he thinks he can do it better with a lot of information floating around, clients ask us more challenging questions and persuade us to take action on their portfolio’s. The team has to spend a lot of time and energy discussing what are the various strategies a fund manager adopts and why all funds do not deliver returns to the same time.

“We spend a lot of time building credibility and earning trust, that what differentiates us from competition.”

The Road Ahead-

“Moving forward I see that a lot of solo Advisors need to embrace external trends a customer needs both advice and DIY execution. With so many website giving them a lot of information on performance and ratings an advisor also need to be tactical on the portfolio management. Buy and hold is a strategy for equities but on fund picking one must be very nimble.”

An Advice to the Investors-

“The first and foremost I would say that no fund manager or wealth manger can create wealth for an investor. It’s the investor who can create wealth by staying invested, continuous churn in the funds or the wealth manager by comparing it with the top performing funds and saying that you have not performed will not create wealth. Wealth creation requires patience and systematic investments, continue your sip’s in bad market SIP are meant for averaging in bear markets. When there is a bull market book profits anywhere above 30% absolute growth and 13% CAGR.

Keep following this discipline, and you will not only create wealth but also conserve wealth.”